stock option tax calculator ireland

Whether its personal use or for business purposes importing or exporting goods can be a cheaper and simple to process using our Duty Calculator. Net Chargeable Gain 1730.

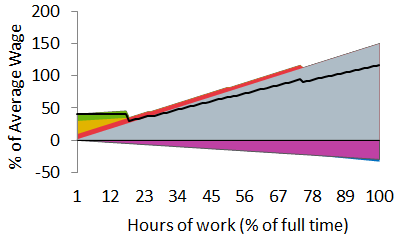

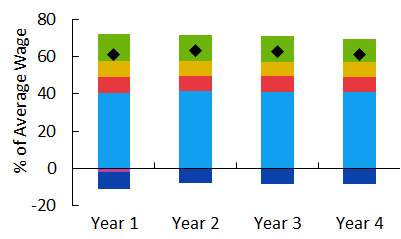

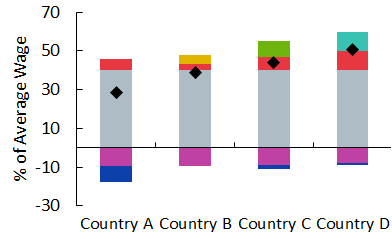

Tax Benefit Web Calculator Oecd

The Ireland Capital Gains Tax Calculator is designed to allow free online calculations for residents and non-residents who have accrued income from capital gains in Ireland.

. Solicitors fees sale 1110. QConnect Large Table Top 12 Digit Calculator Grey Hunt Office Ireland from wwwhuntofficeie. There are 2 tax activities with stock options.

When the option is sold. Tax On Share Options In Ireland How Stock Options Are Taxed In Ireland Crypto Profit Calculator Cryptocurrency Profit Estimator Are Bonds Taxable 2022 Rates Types Of Bonds Tax Minimizing Tips. CGT 33 of 242040.

This is when the employee sells the shares. Any gains you make is either taxed as a Capital Gain 33 CGT or as income where you can pay up to 52 of tax. Taxes for Non-Qualified Stock Options.

That means youve made 10 per share. The value of the benefit is the market value of the shares at the date they were awarded. Tax rates range from 20 to 40.

After brokers fees deducted Chargeable Gain 3000. On this page is an Incentive Stock Options or ISO calculator. How to Calculate your RTSO1 Share Option Tax.

Calculation of Capital Gains Tax on Shares in Ireland. The Ireland Capital Gains Tax Calculator is designed to allow free online calculations for residents and non-residents who have accrued income from capital gains in Ireland. Exercising your non-qualified stock options triggers a tax.

Lets say you got a grant price of 20 per share but when you exercise your stock option the stock is valued at 30 per share. Debt Arrangement Scheme Scottish Das Mortgage Repayment Calculator Repayment Debt Problem How Are Futures And Options Taxed How To Prevent Work Accidents And Compensation Claims As An Employer Small Business Ceo. A short option no charge to income tax arises on the date that the right is granted.

Depending on your income level youll pay between 05 to 8 of your income. Stock options restricted stock restricted stock units performance shares stock appreciation rights and employee stock purchase plans. There are 2 tax activities with stock options.

Income tax USC and PRSI will arise at the time of grant on the difference between the option price and market value of the shares at date of grant. Any income tax due on the exercise of the option is chargeable under self-assessment. Marginal tax rates currently up to 52 apply on the exercise of share options.

Calculation of Marys CGT. You sell them in December 2022 for 8000. When the option is sold.

Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net proceeds. The grant of an iso or other statutory stock option does not produce any immediate income subject to regular income taxes. These shares are a benefit in kind BIK.

From 2011 onwards PRSI 4 and the USC 8 charges also apply. Assuming the 40 tax rate applies the tax on the share options is 8000. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates.

Share options A share option is the right to buy a certain number of shares at a fixed price sometime in the future within a company. This paper profit is immediately liable for income tax and must be paid over to the revenue within 30 days of exercising the option. PRSI funds social welfare programs across Ireland such as pensions.

Personal CGT exemption of 1270. You can pay at a reduced rate 05 to 2 if youre over 70 years old and make less than 60000 or if youre a medical card holder who makes under 60000. Ireland The Global Tax Guide explains the taxation of equity awards in 43 countries.

Stock options restricted stock restricted stock units performance shares stock appreciation rights and. The options were granted within 10 years of the adoption of the Stock. Potentially a Non-Dom could only pay CGT on proceeds from an RSU disposal that they remit into Ireland.

The Stock Option Plan specifies the employees or class of employees eligible to receive options. The Ireland Capital Gains Tax Calculator is designed to allow free online calculations for residents and non-residents who have accrued income from capital gains in Ireland. Paylesstax Share Options Rtso1 Tax Calculator Paylesstax Tax Calculator Excel Spreadsheet Youtube How Fees Can Lower Your Income Tax Koinly What Is The Formula To Calculate Income Tax 60 000 After Tax 2021 Income Tax Uk Paylesstax 6 Easy Steps Paylesstax How To Calculate Cost Basis In Crypto Bitcoin Koinly Online Excise Tax Calculator Makes.

Paying tax on share options in Ireland. When the option is exercisedgranted. This is when the employee purchases the option.

This paper profit is immediately liable for income tax and must be paid over to the Revenue within 30 days of exercising the option. So if you have 100 shares youll spend 2000 but receive a value of 3000. Expected livestock numbers and age per month in.

The Stock Option Plan was approved by the stockholders of the grantor within 12 months before or after the date of adoption of the Plan. Solicitors fees purchase 300. Incentive Stock Option Calculator.

It can also show your worst-case AMT owed upfront total tax and its breakdown and the allocation of income depending on your exercise strategy. If the exercise period is longer and the option price was at a discount on market value at the date of grant then an immediate income tax USC and PRSI charge will arise. Auctioneers fees sale 5280.

Stock option tax calculator ireland. Deduct personal exemption. The Stock Option Plan specifies the total number of shares in the option pool.

You purchased shares in January 2012 at a cost of 5000 including stamp duty and trading fees.

Quickbooks Online Automatic Tax Calculation

How To Calculate Crypto Taxes Koinly

Tax Benefit Web Calculator Oecd

Guide To Claiming The Foreign Tax Credit On Your Dividend Withholding

Quickbooks Online Automatic Tax Calculation

Quickbooks Online Automatic Tax Calculation

Salary Or Dividends Tax Calculations Money Donut

Quickbooks Online Automatic Tax Calculation

The Cares Act Employee Retention Tax Credit Challenges And Opportunities

Quickbooks Online Automatic Tax Calculation

Minimize Your Tax Bill With Index Options Nasdaq

Day Trading Taxes How Profits On Trading Are Taxed

Alan Gourley Partner Grant Thornton Ni Llp Linkedin

2022 Tax Plan Stock Options More Attractive As Remuneration Pwc Tax News

Massachusetts Sets New Due Dates And Filing Requirements For Sales And Use Tax

Quickbooks Online Automatic Tax Calculation